Australia’s retail sector is preparing for another highly competitive Christmas season, as new data on Australians’ Christmas shopping intentions reveals a decade of shifting habits and value-driven expectations.

Now in its tenth year, CPM and Retail Safari’s Christmas Shopping Intentions Report, in partnership with Swinburne University’s CXI Research Group, tracks how Australians plan, shop, and spend for the festive season. This year’s findings confirm that habits forged during the rise of Cyber Weekend and the pandemic years are now entrenched. Value and convenience still drive decisions, but the rise of omnichannel habits and shifting gift preferences are redefining how Australians approach Christmas shopping.

Keep Value Front and Centre

Australians are holding steady in their Christmas budgets, with 79% planning to spend the same or more on gifts this year. The average gift budget sits at $667, showing that while households remain value-conscious, the festive spirit endures.

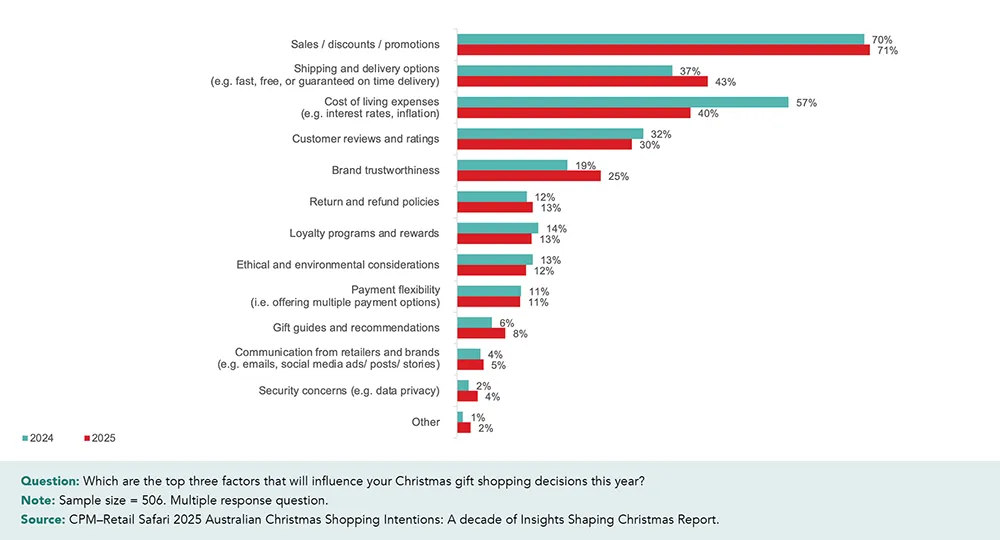

Value remains the top driver of shopping behaviour. Seventy-one percent of consumers say sales, discounts, and promotions most influence where and what they buy. Cards are still the preferred payment method, led by debit cards at 61%.

For retailers, keeping value front and centre is critical. Shoppers are highly strategic, scanning early promotions, comparing offers, and expecting deals that feel genuinely competitive. These findings align with broader trends seen across Australians’ Christmas shopping intentions this year, where value and affordability continue to shape purchase decisions. Success this Christmas depends on matching the right value message with the right moment, across both digital and physical touchpoints.

Cyber Weekend Now Defines Australia’s Christmas Shopping Calendar

This focus on value finds its sharpest expression in the rise of Cyber Weekend, now the defining retail event of the season.

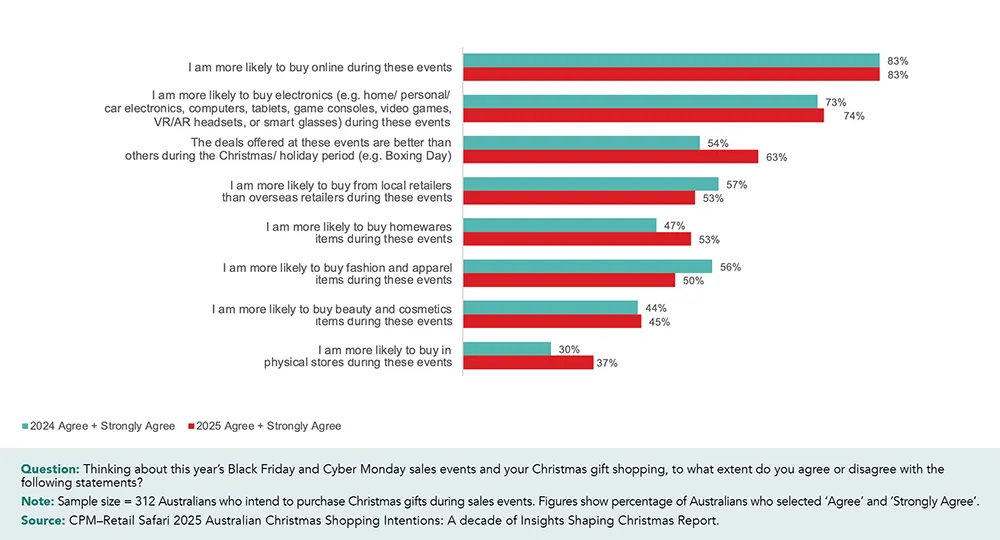

Fifty-five percent of Australians plan to buy Christmas gifts during Black Friday or Cyber Monday, and nearly two in three (62%) intend to shop during major sales events overall. Perceptions of value have strengthened, with 63% of consumers believing Cyber Weekend offers better deals than other events, including Boxing Day.

While deal activity intensified across the board, shopping at physical stores also increased, from 30% in 2024 to 37% in 2025, showing how retailers have successfully extended Cyber Weekend beyond digital channels and into bricks-and-mortar retail. The events are also demographically driven, with younger Australians (18–34) leading the charge: 79% plan to shop during sales events, compared with 42% of those aged 55 and over.

Electronics remain the top Cyber Weekend gift category at 74%, underscoring the event’s reputation for tech bargains.

The Omnichannel Christmas Is Here to Stay

Shopping in Australia is now channel-agnostic. Eighty-nine percent of consumers plan to shop both in-store and online this Christmas, matching last year’s record high. Online marketplaces (64%) and department stores (57%) lead, but physical stores continue to play a critical role.

Shoppers go in-store to see and touch products, while comfort and convenience drive online purchases. Even in a world of Kindles, e-books, and audiobooks, bookstores have made a strong entry at 36%, particularly among 35–54s (43%). Toy stores remain important for families (41% of 35–54s), while social media platforms have made their debut as a shopping channel (4%), driven by younger audiences.

Retailers that create consistent, frictionless experiences across channels will be best placed to capture this blended behaviour. The expectation is no longer digital or physical; it is both.

Gift Preferences Are Shifting

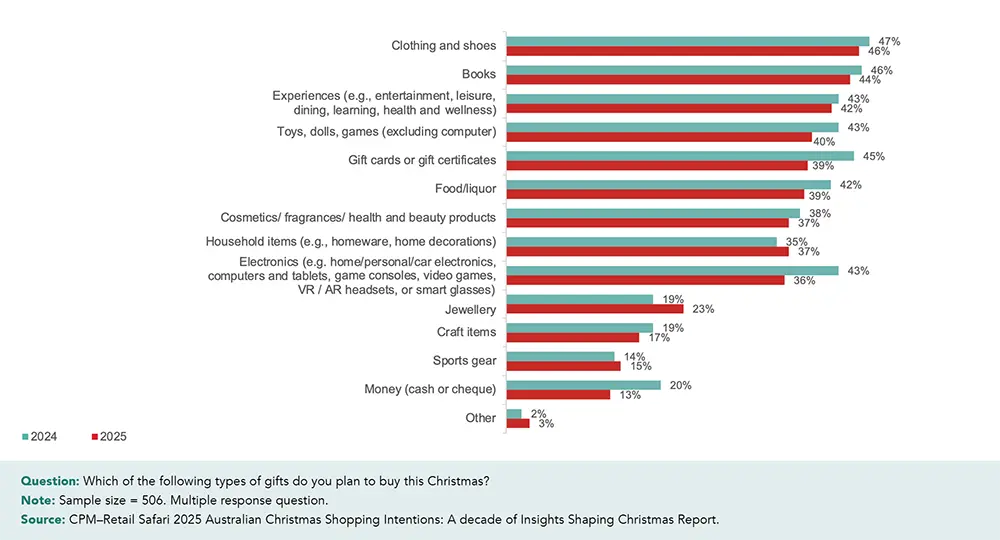

As shopping journeys have become more blended, Australians’ gift choices have diversified, combining practical, tangible and experience-based gifts.

After years of dominance, gift cards have fallen from first to fifth place on Australians’ Christmas lists. Clothing and shoes (46%), books (44%) and experiences (42%) now lead 2025’s top gifts.

Younger Australians (18–34) are driving the experiences trend, with 55% planning to give leisure or entertainment gifts. Meanwhile, 35–54s are the biggest buyers of clothing and books. This pivot reflects a deeper consumer desire for gifts that are meaningful and personal rather than purely functional.

Retailers that curate personalised, experience-led gifts can differentiate in a crowded marketplace and connect emotionally with shoppers.

AI Awareness Grows, But Adoption Remains Limited

Technology is becoming part of the Christmas shopping conversation, but not yet the transaction. Most Australians are not ready to embrace AI tools for Christmas gift shopping in 2025.

Fifty-eight percent say they will not use AI, while 21% of 18–34s are open to trying it compared with only 11% of those aged 55 and over. The 55+ group shows the highest resistance (67% say “No”), and a large ‘unsure’ segment among 35–54s (31%) suggests potential for future uptake if these tools prove useful.

ChatGPT dominates as the AI tool of choice for those open to using AI this season. Three in four (75%) plan to use ChatGPT, well ahead of Google AI Overview (41%), with Bing/Microsoft Copilot (9%) and retailer-based tools (8%) trailing far behind.

The generational divide is clear. Eighty-seven percent of younger Australians (18–34) who plan to use AI expect to rely on ChatGPT, compared with 60% of those aged 55+. Shoppers aged 35–54 show higher interest in Google AI Overview (49%), while many older Australians remain uncertain about which tools they would use.

For now, AI’s role in Christmas shopping remains exploratory, limited to a handful of major platforms. Retailers have an opportunity to experiment with low-risk, value-adding applications such as guided gift finders or personalised recommendations.

Winning the Christmas Shopper

Ten years of data show that Australians’ Christmas shopping habits have transformed permanently. They are now firmly focused on November and Cyber Weekend for their gift shopping. Omnichannel is the standard, and gifting preferences continue to evolve toward meaning and experience.

Christmas 2025 is a story of continuity and change. For retailers, success will depend on acting early, pricing competitively, ensuring seamless omnichannel experiences, and preparing for emerging behaviours that will shape the next phase of Christmas shopping.

Read the key trends shaping 2025 in the Australian Christmas Shopping Intentions: A Decade of Insights Shaping Christmas Report.